STEER has strong experience in the FMCG businesses with our reach extending to large groups pan India and abroad (through our partners)

In depth knowledge & understanding of the domain has ably helped us in providing growth to late stage private equity funding to companies in this space. With our extensive network & relationship in this domain, we have also assisted clients on M&A opportunities.

STEER is largely focused on sub-sectors like personal care, cosmetics, personal hygiene, retail and F&B.

Assisting prominent / niche international brands in the areas of consumer / personal Care and F&B regarding their entry into India in terms of establishing joint venture with strong Indian groups, distribution tie-ups, franchisee arrangements.

STEER has completed/has been mandated for deals in areas of personal care, cosmetics, retail and F&B.

STEER is an active advisor to various entrepreneurs in the F&B space. With the sector witnessing a strong deal flow, STEER has been at the forefront in advising clients across categories like QSRs, cafes, Ice creams, health drinks & more.

Strong domain knowledge combined with an experienced team has ensured a strong client base. Having worked with different investors in this sector, STEER has the ability to understand the investor’s thought process.

STEER is presently working on the following transactions in the above sector:

Our work in the Retail Space includes a few key transactions like assisting a prominent retail chain from USA on its entry into India by establishing a Joint Venture with strong Indian Group (JVs, Distribution Tie-ups and Franchisee arrangements).

STEER was one of the earliest firms to focus on this segment. Even though transactions in this segment have been limited so far, we believe there is long term potential in this segment and continue to be committed on it on an ongoing bases.

Our contribution in this segment has been through:

We are not only advising the companies but are also investing in early stage start-ups in EV ecosystem across batteries, battery management systems (BMS) manufacturers, charging & charging infrastructure, integrated power trains, components, etc.

STEER was one of the earliest firm to focus on this segment. Even though transactions in this segment have been limited so far, we believe there is long term potential in this segment and continue to be committed on it on an ongoing bases.

India is on a cusp of a significant growth in this industry. Hence our focus on this segment as a long term partner will continue.

Our contribution in this segment has been through advising on M&A, Joint Venture(s) and Fund(s) raised through Debt / Equity. The companies whom we have facilitated were involved in processes like machining, electronics, composites, product assembly, component Manufacturing, providing specialised alloys, etc. for this sector.

When required, we also have ability to bring an industry professional to augment the client’s management team and to provide strategic input/tie ups.

We are working on M&A, Joint Venture and fund raising opportunities such as:

We have facilitated Joint Ventures, Product off-take agreements and Offset related tie-ups across PCB and PCB Assembly, Optics, High end Metallurgy and Forging capabilities and, technology transfer in the Defence space.

Our reach extends from Medium to Large Enterprises focused on Defence / Aerospace in India and abroad (Israel, U.S.A) in this sector.

We are one of the earliest to focus on Paper & Packaging Industry, recognising the potential for growth of this industry in a fast growing consumer economy like India.

We have been extensively working in Paper & Paper based packaging industry and gradually we have also increased our focus on flexible packaging. Having worked with leading global companies and fast growing home grown companies in this space, we understand where the industry in India stands in comparison to the larger mature market like Europe & U.S.

We have recently concluded a fund raising transaction for a leading packaging paper manufacturing company in the western region of India, and we continue to work with most of the prominent names in the Industry and advise them on their capital requirements & strategic initiatives.

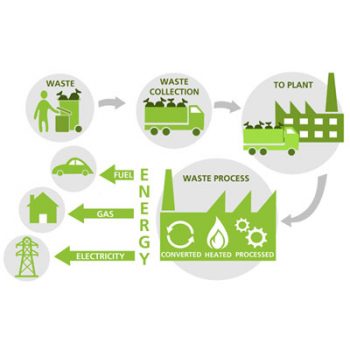

Having worked with some of the leading companies in different sub-segments within the Waste Management Industry, Steer has developed a good understanding of the Industry and the Sub-segments.

Across Waste management Industry, steer has worked with companies in Sub-segments such as

Steer also closely works with strategic and financial Investors focussed in the Waste management Industry and understands their perspective on the different industry segments and geographies, thereby facilitating investment in this emerging Industry in a better way and contributing towards the overall growth of the Industry.

Worked with one of the leading consumer electrical company. Building material & consumer electricals is a sector that we extensively work in and have successfully closed transactions in this sector.

Advisory services to NBFCs for Structuring, M&A and Fund raising.

Prior experience with leading NBFCs such as Reliance Capital, Religare Enterprises, Future Capital (now Capital First) etc.

Advisory services to Microfinance companies for Structuring, M&A and fund raising.

Worked with established and emerging MFIs in India such as ESAF, Chaitanya, Pahal, Samasta, Shikhar etc.

Logistics : Logistics Parks, 3PL, CFS and Freight Forwarding

Metals

Information Technology (through our partner firm in the U.S.A)